The tips below can help you complete CP207 Remittance Slip For Form C - Lembaga Hasil Dalam Negeri easily and quickly. The issuance of Tax Clearance Letter is subject to the complete documents and information received with the consideration of these criteria.

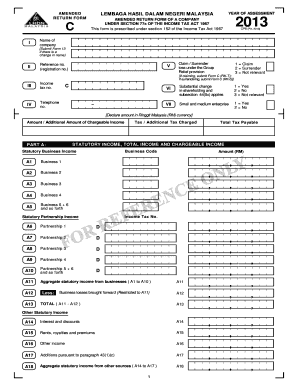

C5 TOTAL TAX PAYABLE C3 C4.

. Best Viewed in Internet Explorer 6. A CONTROLLED TRANSACTIONS In IRBMs continued efforts in tightening transfer pricing compliance they have included additional disclosure requirements in respect of. PROGRAM IBADAH KORBAN JOM RAMAI-RAMAI REWANG ANJURAN HASiL CAWANGAN KUANTAN SEMARAKKAN SAMBUTAN AIDILADHA TAHUN 2022.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Attached is a. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut.

3 This sample form CANNOT be used for the purpose of submission to Lembaga Hasil Dalam Negeri Malaysia LHDNM. C3 TAX ADDITIONAL TAX CHARGED C1 C2. GUIDE NOTES FOR FORM C AND FORM R FOR YEAR OF ASSESSMENT 2012 Director General of Inland Revenue Lembaga Hasil Dalam Negeri Malaysia Date.

1 Due date to furnish return form and pay the tax or balance of tax payable. This form must be submitted together with the supporting documents as per Appendix A to the LHDNM branch that handles the income tax file of the respective company. Adalah dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia LHDNM akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem LHDNM.

LHDN officially announced the deadline for filing income tax in 2021. 3 This sample form CANNOT be used for the purpose of submission to Lembaga Hasil Dalam Negeri Malaysia. The deadline for BE is April 30.

How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. Fill in the necessary fields which are marked in yellow. Constituent entities can now use the C Form to submit the Country-by-Country Reporting CbCR Notification starting in YA 2021.

Use separate forms if the number of companies surrendering the loss exceeds five 5. Form C refers to income tax return for companies. Constituent entities that file other forms should continue to provide notification in the same manner as before.

This form shall become part of the Form C pursuant to section 77 A of the Income Tax Act 1967. Ibu Pejabat Lembaga Hasil Dalam. Previous tax payable From B8 of original Form C.

Press the arrow with the inscription Next to jump from one field to another. A statement under section 77A of the Income Tax Act 1967 ITA 1967. This form shall become part of the Form C pursuant to section 77 A of the Income Tax Act 1967.

7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. Open the template in the full-fledged online editor by clicking on Get form. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. We wish to highlight that the Inland Revenue Board of Malaysia IRBM has recently released a new format of the Company Return Form Form C for Year of Assessment 2019. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN.

Use separate forms if the number of companies surrendering the loss exceeds five 5. Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. C4 Increase in tax under subsection 77B4 in respect of Amended Return Form furnished within a period of 6 months after the due date for the submission of Return Form C3 x 10.

E - Janji Temu. On and before 3042022. Letter of authority verified copy of Form C RK-S from each surrendering company must be retained for examination by Lembaga Hasil Dalam Negeri Malaysia.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. ELAUN JADUAL 3 JADUAL 7A DAN JADUAL 7B C1a Maklumat elaun Jadual 3 Isi HK-E dan ruang. An income tax computation pursuant to subsection 77A3 of ITA 1967.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Income tax return for companies.

Employers who have submitted information via e-Data Praisi need not complete and furnish Form CP8D. Employers are required to complete the form in Excel or txt file format on all their respective employees for the previous year. Kuantan 13 Julai 2022 - Bersempena dengan Sambutan Hari Raya Aidiladha 1443H2022 Lembaga Hasil Dalam Negeri Malaysia HASiL Cawangan Kuantan telah melaksanakan Program Ibadah Qurban.

Letter of authority verified copy of Form C RK-S from each surrendering company must be retained for examination by Lembaga Hasil Dalam Negeri Malaysia. From Ist JUNE 2016 onwards please fill up checkout details of the foreigners using Check Out Departure Entry after Login into Form C. The deadline for submitting Form E is March 31.

Form is furnished d ii To. LEMBAGA HASIL DALAM NEGERI MALAYSIA SYARIKAT DI BAWAH SEKSYEN 77 A AKTA CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 Borang TAHUN TAKSIRAN C 2020 CP5 - Pin. COMPANY RETURN FORM FOR YEAR OF ASSESSMENT 2020 1 Due date to furnish Form e-C and pay the balance of tax payable.

E - Janji Temu. 7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by sending an e.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. Ibu Pejabat Lembaga Hasil Dalam. The deadline for Form B and P is June 30.

Business Income Tax Malaysia Deadlines For 2021

Borang C Lhdn 2020 Fill Online Printable Fillable Blank Pdffiller

Business Income Tax Malaysia Deadlines For 2021

Income Tax Deadlines For Companies Malaysian Taxation 101

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

Form B Fill Online Printable Fillable Blank Pdffiller

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

C Form Fill Online Printable Fillable Blank Pdffiller

Business Income Tax Malaysia Deadlines For 2021

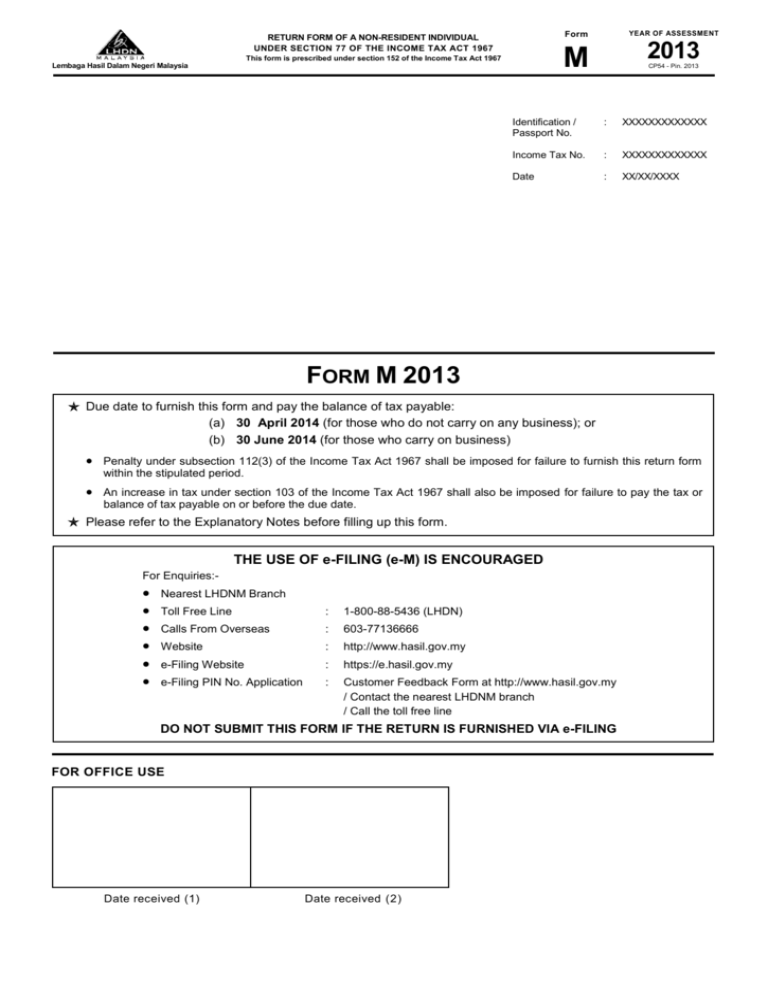

Form M 2013 2013 Lembaga Hasil Dalam Negeri

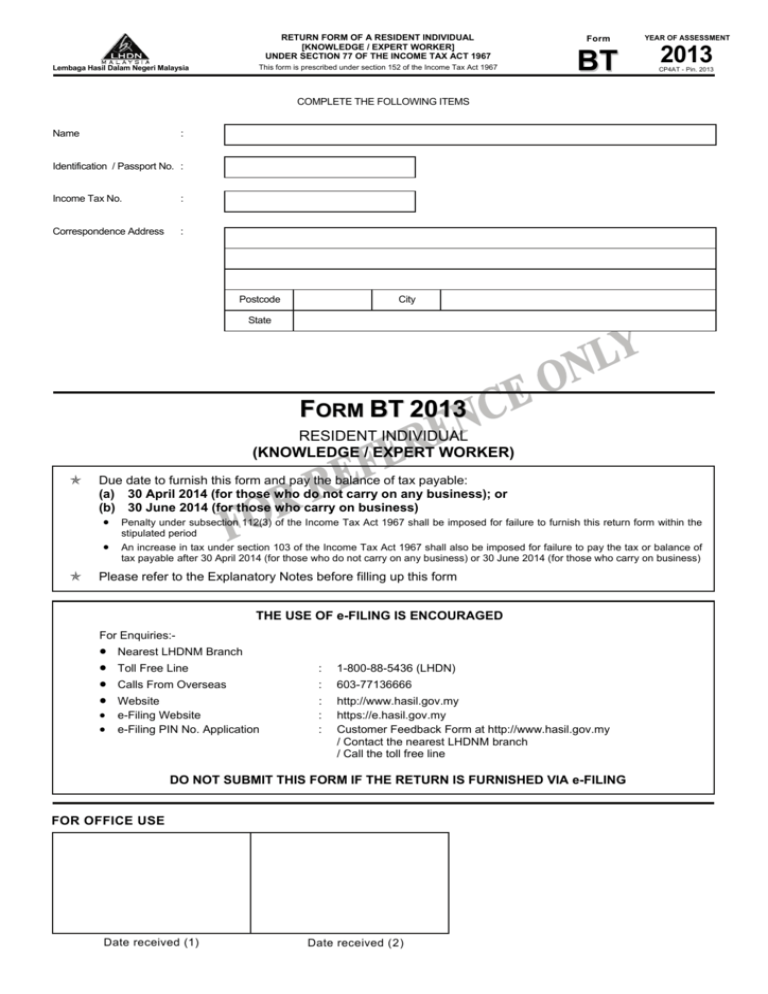

Bt 2013 2013 Lembaga Hasil Dalam Negeri

Business Income Tax Malaysia Deadlines For 2021